Abstract

The insurance industry is innovating. Business models, services and processes are rapidly evolving, largely backed by technological developments. The particular historical context of COVID-19 provides a suitable case to understand the relevance of exploiting technology to react quickly to traditional and emerging risks. Focusing on the initiatives put in place by the most influential insurance companies at the global level, we have framed the innovation mechanisms in the industry, highlighting four rationales underpinning these initiatives (Adaption, Expansion, Reaction and Aggression), which differ according to the relevance of the technology in use and innovation to the portfolio of risks covered. Overall, it emerges that insurance companies have the room and capability to innovate, in many cases using technological applications to cover new and existing risks. While the initiatives studied concern the entire value chain, basic primary activities, such as product development, sales and claims management, show that innovation based on new or existing technology determines the success and competitiveness of the business.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the absence of insurance, it would be complicated for individuals and businesses to cope with the negative consequences of economic activity or mitigate the effects of uncontrollable events and so recover from unfortunate situations or, at least, contain the ensuing financial burden (Zweifel and Eisen 2012). This point is becoming clearer and clearer as our world faces increasing levels of uncertainty. By transferring the risk of a loss, insurance certainly played a major role in protecting people from consequences arising from the COVID-19 pandemic (Liedtke 2021; Qian 2021), an event not even listed among the 20 most likely risks before 2020 (World Economic Forum 2020).

The social value of the support insurance companies provide to consumers is undeniable (The Geneva Association 2012; OECD 2020). During the pandemic, this included deferring premium payments, adjusting coverage terms and conditions and even providing additional coverage benefits, although insurers did not always provide transparent or clear information to policyholders about coverage conditions, in particular on the exclusions relating to COVID-19 losses (OECD 2020). Thus, while in some cases insurance companies rejected consumer claims, the fact that the population had a coherent insurance coverage mitigated the most negative effects of the pandemic. Health insurance, for example, was able to provide a better quality of life and more extensive healthcare for those who were covered; a lack of coverage could have led to delayed diagnosis and repercussions on physical and psychological health, including high stress levels (Shin et al. 2021; Sampson et al. 2021).

COVID-19 acted as a catalyst for innovation in insurance, as in other service industries (Heinonen and Strandvik 2020), although the insurance industry is generally known for its conservatism (Nam 2018). The sector is, so far, clearly struggling with innovation and change (Zweifel 2021; Nam 2018), and insurance companies are not taking full advantage of the intangible nature of their products and services, which could enable them to become digital leaders (Stoeckli et al. 2018), despite several efforts having been made. Data abundancy has facilitated the emergence of new insurance business models, ranging from peer-to-peer insurance (Stoeckli et al. 2018) and personalisation achieved through wearable devices (McCrea and Farrell 2018; McFall 2019) to insurance policies tailored to individual behaviour (Dijksterhuis et al. 2016), such as pay-how-you-drive (PHYD) policies, where pricing reflects driving style (Stoeckli et al. 2018). Ultimately, these kinds of pay-as-you-live policies induce policyholders to adopt preventive measures (Wiegard and Breitner 2019), with potential economic and financial benefits. However, legal concerns must be considered, as using self-tracking data to assess and price individual risk (Cather 2020) is fraught with practical, regulatory and reputational obstacles (McFall and Moor 2018) and the availability of technological solutions is not a guarantee of better performance per se (Lanfranchi and Grassi 2021).

COVID-19 drove innovation mechanisms in the industry (Heinonen and Strandvik 2020) and forms the context of this research. We observed the greater or lesser relevance of innovating through the medium of technology, whether already in place in these companies or introduced for this purpose, and how technology can help companies to react quickly to traditional and/or emerging risks. By analysing the most representative insurance companies at the global level, this research focuses specifically on the role played by technology and market impulses in cultivating innovative initiatives in the sector. Our aim is to provide tangible support to insurance companies when they are working on their future innovation designs, ensuring that they first have a clear idea of the role that they want to attain, or maintain, in the market. Any chosen direction will depend on their attitude to risk and their risk strategies, while careful attention must be paid to potential pandemic or global systemic events akin to the COVID-19 pandemic that could arise in the future, nowadays considered decidedly more probable than in the past (World Economic Forum 2021).

The rest of the paper reviews extant literature by presenting the main studies on technology and market impulses that give rise to innovation. The subsequent sections will provide details on the methodological aspects (Methodology), followed by a discussion of the results (Results and Discussion) and the conclusions (Conclusions).

Overview of innovation processes and models in insurance: technology and market impulses

The role of technology

Digital transformation has become an important enabler of innovation (Urbinati et al. 2020). In recent years, the surge in innovation has also interested financial markets (Guo and Liang 2016). Eling and Lehmann (2018) analysed the impact of digitalisation on the insurance value chain, highlighting that the main areas affected are interaction with customers, adaptation to their behaviour, automation of business processes and decisions, improvements to existing products and new product offerings. A new concept, InsurTech, a “phenomenon comprising innovations of one or more traditional or non-traditional market players exploiting information technology to deliver solutions specific to the insurance industry” (Stoeckli et al. 2018, p. 289), is gaining interest within the insurance sector, driven by increased customer satisfaction and efficiency (McKinsey & Company 2018). The concept has a significant place within society as well; InsurTech offers new opportunities, such as higher insurance inclusiveness (Altamirano and van Beers 2018), individual empowerment (Zavolokina et al. 2016) and improvement to public health (Yamasaki and Hosoya 2018).

The effects of InsurTech are being felt across various types of insurance. For instance, health insurance must deal with the emergence of new medical technologies and wearable devices, which can be used to gather useful but sensitive patient data (Banerjee et al. 2018) and convert a previously uninsurable physical health risk into an insurable risk (Lakdawalla et al. 2017), while artificial intelligence can give users digital access to their health status, enabling them to improve their health-related behaviour (Yamasaki and Hosoya 2018). Looking at the home insurance industry, big data analytics and artificial intelligence play a central role in providing services that aim to prevent or mitigate losses, as people purchasing home insurance benefit from real-time acknowledgement of potentially dangerous situations (Lehrer et al. 2018). Furthermore, new technologies can be used to estimate loss distribution in the agricultural insurance industry, in particular, new geospatial web-based applications and cloud-based solutions (Hiestermann and Ferreira 2017). In general, we can now gain a better understanding of the exposure to risk associated with natural disasters, a key point in assessing the need for catastrophic insurance, for instance (McAneney et al. 2016).

InsurTech can also help to improve existing products, services and processes, as well as enable new business models. For instance, advanced technology underpins insurance models ranging from behaviour-based pricing, widely studied in the car insurance industry (Derikx et al. 2016; Weidner et al. 2016; Wijnands et al. 2018), to personalisation linked to data retrieved from wearable devices (McCrea and Farrell 2018; McFall 2019). Peer-to-peer insurance models are another example, where people can partly share risks with each other (Stoeckli et al. 2018). These can contribute to rebuilding trust in the insurance industry by reducing conflicts of interest, as usually these solutions do not include any entities that benefit from refused claims (Stoeckli et al. 2018). Nevertheless, InsurTech may possibly introduce new concerns like privacy issues (Banerjee et al. 2018) and discrimination, for instance in price personalisation (Meyers and Van Hoyweghen 2018), or result in non-improvement of efficiency (Lanfranchi and Grassi 2021).

The role of the market

Insurers provide protection and encourage a better understanding of risks, reducing public anxiety and concern (McAlea et al. 2016) and helping entrepreneurs, individuals and corporations to handle risk. They also support continuing advancement by proposing new products (Śliwński et al. 2017). However, if insurance companies are to play a central role in society, creating value for their customers by transferring the risk of a loss from one entity to another in exchange for payment, they must be ready to serve the current and prospective needs of the market. Therefore, the insurance sector can innovate its products and processes in a twofold manner, firstly by dealing with market demand and customers’ existing risks and secondly by addressing new risks. Consumers are increasingly demanding offers that are better value for money, more convenient, better quality and more suited to their own requirements (Kose et al. 2018). The availability of data can give impulse to new initiatives. New medical technologies provide additional information, meaning that it is now possible to insure illnesses in cases where the risk distribution was not previously known (Lakdawalla et al. 2017), while a lack of data can hinder these risks from being insured (McAlea et al. 2016). The profusion of new and emerging risks is escalating and becoming more critical, with risks derived from changing business environments, disruptive environmental patterns, evolving social and demographic trends, technological advancements (as well as the increasing relevance of data) and new medical and health concerns (Capgemini and Efma 2019) that generate additional innovation impulses.

Literature on innovation processes is flourishing and different models are emerging all the time (Du Preez and Louw 2008). Technology and market demands have been recognised as the two main drivers of innovation (Voss 1984; Van den Ende and Dolfsma 2005; Brem and Voigt 2009; Di Stefano et al. 2012; Maier et al. 2016). Technology (Maier et al. 2016) enables the creation of commercialised innovative products (Du Preez and Louw 2008; Maier et al. 2016), as well as innovation in services (Geum et al. 2016) and processes (Brem and Voigt 2009). In the same way, customer needs and the market itself are the source of new ideas (Du Preez and Louw 2008) that aim to satisfy consumer demands (Nicolov and Badulescu 2012). The research question guiding this study thus relates to how insurance companies innovate by leveraging technology to address market needs in response to the COVID-19 pandemic.

Methodology

We built on research on technology and market innovation to set out a conceptual framework of the potential ways in which insurance companies can innovate. Considering the exploratory nature of our work, we conducted 30 case studies on an inductive basis, moving from the specific to the general, which is suitable in cases where previous literature studying a situation or concept is scarce or fragmented (Elo and Kyngäs 2008).

Our sample is composed of the most representative insurance companies at the global level, i.e. the top 30 by net written premiums (source: Orbis database, see the Appendix for an overview of these companies). We systematically mapped the initiatives taken by each company to address the COVID-19 pandemic, with a focus on their short-term responses (i.e. the first quarter after the start of the pandemic).

To gather data on the initiatives, we triangulated information from two sources. The first is the insurance companies’ websites, which have been used as a source of information in previous research (Ashta 2018; de Oliveira Malaquias and Hwang 2018). The websites mostly include information relating directly or indirectly to the company’s innovation status (Axenbeck and Breithaupt 2021) and were the first touchpoint used by customers during lockdowns to learn about newly implemented initiatives. They were thus used as a way for insurance companies to share news on their innovations with their customers. The second consisted of press releases and investor relations. These were the main sources of official information for shareholders, stakeholders and customers, conveyed virtually through various media channels.

To identify the innovative initiatives properly, we based our work on Baregheh et al. (2009, p. 1325), according to whom “Innovation can be defined as the effective application of processes and products new to the organization and designed to benefit it and its stakeholders”. We searched for results that satisfied the following three properties. Firstly, they had to be real company initiatives, so we disregarded opinion papers or suggestions for the industry, taking the position that innovations are such when they are effective and tangible applications (Baregheh et al. 2009). Secondly, the initiatives had to create value, provide benefit and economic value (Garcia and Calantone 2002) to at least one stakeholder, and/or solve a problem or a social need (Edwards-Schachter 2018). Thirdly, the initiatives had to have been developed as an immediate response to the COVID-19 pandemic. Data were supplemented by a thorough analysis of secondary sources, such as business news channels (e.g. CNBC), articles from industry-specific and business magazines (e.g. Forbes) and interviews published in the press (e.g. CEO of Company 1). Where possible, we directly tested the tools under study ourselves (e.g. the Company 13 chatbot).

We analysed these materials through content analysis, a widely-adopted method (Elo and Kyngäs 2008) that provides a systematic and objective means of describing phenomena (Krippendorff 1980; Downe-Wamboldt 1992; Sandelowski 1995), enabling researchers to make “replicable and valid inferences from data to their context, with the purpose of providing knowledge, new insights, a representation of facts and a practical guide to action” (Elo and Kyngäs 2008, p. 108). All the authors were involved in the analysis to reduce personal bias.

Results

The top 30 insurance companies launched 112 initiatives overall (Table 1). Most insurance companies had introduced specific initiatives, except for five companies where no innovation was reported and which remained conservative. With more than five new initiatives in a couple of months, some companies were clearly more responsive, stating their commitment towards their customers and drive for innovation, and they are also the largest in terms of net written premiums.

Considering the specific insurance line in which the different initiatives are developed, we see a clear prevalence of health insurance initiatives (54%), which is reasonable considering the nature of the pandemic event. Another 27% of initiatives is transversal to all insurance lines (ranging from health insurance to car insurance, home insurance and so on). Overall, 81% of initiatives dealt specifically or generically with health concerns. Initiatives in other insurance lines were less common, with car insurance (5%) and home insurance (4%) slightly more relevant.

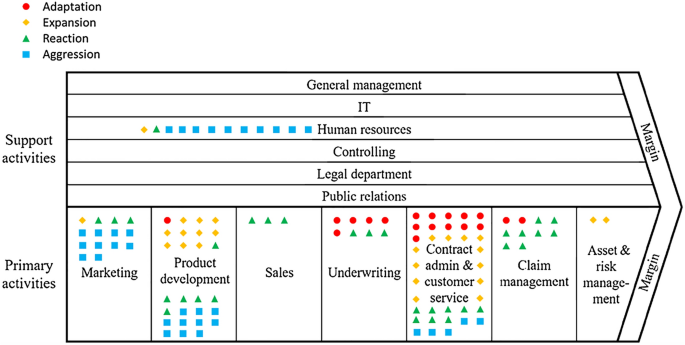

Further, the initiatives covered different activities of insurance companies. Accordingly, we decided that the first step was to map their impact on the different activities within the insurance value chain (Rahlfs 2007, Fig. 1), following Eling and Lehmann (2018). Primary activities refer to the creation of products/services and their transfer to the buyer (Porter 2008). These initiatives spread across all activities, from product innovation, such as creating solutions to address the risk of infection (e.g. artificial intelligence-based symptom checkers developed by Company 8) to innovations in services and processes (e.g. making claims remotely by phone, internet, e-mail or app, introduced by Company 9). Support activities refer to those that support primary activities by providing various firm-wide functions (Porter 2008); these were also impacted, e.g. HR practices, with many companies implementing distance-working solutions (e.g. Companies 1 and 27).

Distribution of initiatives along the insurance value chain by rationale (insurance value chain from Rahlfs 2007)

The role of technology

Focusing on technology, insurance companies responded to the pandemic in two main ways. On the one side, they exploited their existing technological arrangements, expanding their use or opting to adopt new technologies. In the U.S., Company 13 trained its existing chatbot to detect suspicious infection in a timely manner. In addition, the chatbot had a marketing purpose, as it could also propose appropriate insurance products offeed by Company 13. Several insurance companies, including Company 22, offered remote medicine solutions to their customers, e.g. live-video conferencing with medical experts, with the aim of reducing infection by avoiding doctors’ surgeries. At the same time, there were cases where technology was not always central to the insurance company’s response. For instance, several insurance companies, such as Company 1, extended their grace period for paying premiums (especially for customers who typically paid in cash in a brick-and-mortar agency or who were facing temporary financial difficulties). Others, including Companies 7 and 16, extended their existing health insurance cover and explicitly included coronavirus infections.

The role of the market

During the worst stage of the pandemic, insurance companies found themselves dealing with new risks, but at the same time they had to deal with those already in place. The risk of infection was clearly central in extending existing products. Customers benefitted from extended policy coverage, as did doctors in their professional civil liability insurance (e.g. a subsidiary of Company 27) with reference to telemedicine and everything else beyond their usual sphere of expertise deployed while fighting the pandemic. Collateral psychological issues related to lockdown measures raised concerns. The responses ranged from a 24/7 hotline during the crisis (e.g. Company 22) to a COVID-19 microsite and emotional support (e.g. Company 22) and free subscriptions to Netflix and Spotify (e.g. Company 9 in Turkey). Qualified personal trainers, chefs and dieticians were brought in to offer free advice and consultations on matters relating to nutrition and wellness, and customers were offered discounts for home grocery deliveries (e.g. Company 9 in Turkey). Insurance companies set up initiatives linked to many primary activities in the value chain that had been affected by the pandemic. For instance, with regard to claims management, in one case Company 25 and its supplier were able to determine the cause of a house roof leak through a ‘drive-by’ survey.

Discussion

Cases can be distinguished into two sets according to the relevance of technology. In the first, existing technologies were ratcheted up and technological innovation introduced in answer to the emergency; in the other, technology did not play a major role.

Cases can also be classified according to the level of innovation in the portfolio of risks covered by the insurance companies. In this classification, the first set consists of insurance companies that innovated their portfolio of risks covered, implementing initiatives to create value for customers facing new difficulties. The second set consists of insurance companies that adopted solutions intended to deal with existing risks.

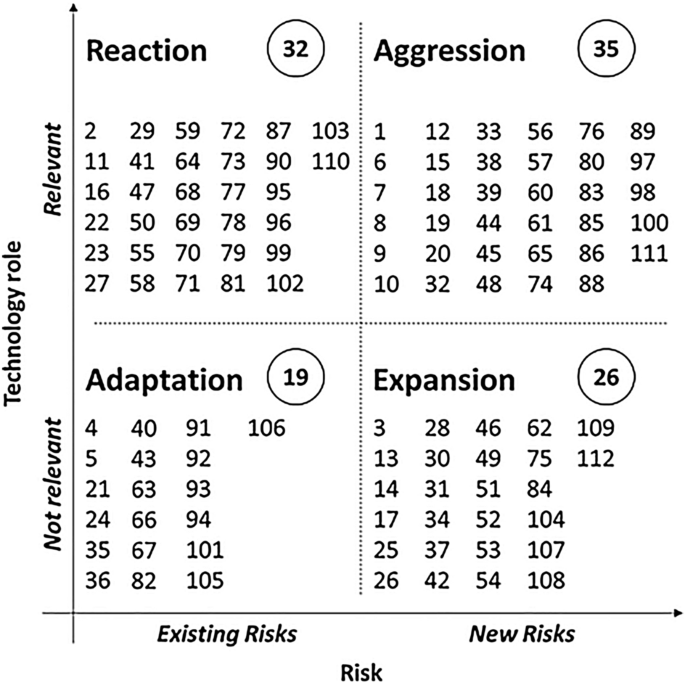

Building on the evidence from the various cases, we extrapolated four different rationales for the initiatives (Fig. 2), based on the relevance of the technology (high–low) and the market-driven risk portfolio (focus on existing risks–new risks). The four rationales gave rise to four classes: Adaption, Expansion, Reaction and Aggression.

Technology and market impulses in innovation as a response by insurance companies to COVID-19. Each initiative is mapped on the basis of the role played by technology and the risk to which it refers. Four classes have emerged: Adaptation, Expansion, Reaction and Aggression. The encircled data refer to the number of initiatives. The numbers in each sector refer to our coding of each initiative

Adaptation (low relevance of technology/focus on existing risks)

These initiatives address needs relating to pre-existing risks, where technology did not play a major role. Many of these initiatives concerned underwriting (five out of 19). Examples include flexibility in premium payments (e.g. Company 29) and special enrollment periods for companies to offer health cover to employees who had previously declined such cover (e.g. Company 1). In contract administration and customer services (11 out of 19 initiatives), insurance companies adapted their premiums ex-post, reducing them as a consequence of fewer claims (e.g. Company 26: 15% refund on two months’ car insurance premiums for their customers). In this class of initiatives, the technology impulse is clearly limited, while the market impulse consists of consumer demand for insurance companies to provide a service appropriately adapted to the specific context, possibly minimising the negative impacts of the pandemic.

Expansion (low relevance of technology/focus on new risks)

These solutions address new risks, without requiring technology to play a major role. Initiatives in this class were mainly in contract administration and customer services (12 out of 26). Several insurance companies (e.g. Companies 1, 7 and 22) expanded the areas covered in their health insurance policies, for example by waiving co-payments, coinsurance and deductibles for diagnostic tests, treatment and health complications associated with COVID-19. Moreover, Company 22 and other insurance companies enabled expedited access to treatment. In the U.S., hospitals in some states with high numbers of infections, such as New York and Washington, no longer needed advance approval from Company 22 to admit their insured patients requiring hospitalisation. Expansion initiatives concerning product development were also put in place (10 out of 26). For instance, Company 9 expanded its portfolio by offering insurance to all Chinese medical experts in Italy, in order to protect their safety and health more comprehensively. These initiatives are hence not linked to strong technological impulses; the market impulse was related to customer demand, with users asking insurance companies to expand the scope of their usual services and products to address new risks.

Reaction (high relevance of technology/focus on existing risks)

These initiatives address pre-existing risks, with the aim of reacting to the difficulties arising from the pandemic, and continue serving customers in an effective and efficient way by making greater use of current technologies or adopting new ones. Some of these initiatives concerned contract administration and customer services (eight out of 32), with several insurance companies (e.g. Company 13) temporarily waiving members’ out-of-pocket costs for telehealth consultations (also known as telemedicine). Similarly, due to lockdown restrictions and the need to reduce the movement of people, Company 22 expanded its telehealth coverage and offered all telehealth consultations with their network providers at no cost to all their members. Concerning claims management, there were a significant number of reactive initiatives (eight out of 32). Many insurance companies (e.g. Companies 25 and 26) stopped all in-home damage inspections to avoid their employees entering people’s homes. Instead, they conducted remote claims assessments through video chat lines or video collaboration tools. Concerning sales-related initiatives (three out of 32), an interesting example came from Company 17. Under the restrictions imposed by various local authorities, the company operated with skeleton staff in its branches and call centres, requiring people to use the internet more intensely, while pointing to the benefits and ease of purchasing from the safety of one’s home. Consistent with Eling and Lehmann (2018), it is clear that the range of different responses in the market had built on digital interaction between customers and insurance companies from the beginning of the sales process (e.g. Company 8) and throughout the validity of the policy, whether the policyholder had made a claim (e.g. Company 25) or not (see, for instance, Company 20’s wellness advice). In this class of solutions, the technology impulse is significant, allowing companies to react to the emergency and continue serving the market, providing the same experience as before, regardless of the specific situation.

Aggression (high relevance of technology/focus on new risks)

Many insurance companies started leveraging their existing technologies to develop products for dealing with the new risks. A Swiss-based telehealth subsidiary of Company 8 introduced artificial intelligence-based symptom checkers to help patients decide whether they were infected, as well as wearables and diagnostics to better understand patient needs and steer them towards their nearest healthcare facilities. Similarly, Company 7 was working to provide speedy health assessments via its mobile app, which members could download at no cost. Digitalisation was instrumental to both new and existing products. Technology enabled insurance companies to update and improve traditional products centred on protection, such as helping members isolating in their homes get through difficult patches (e.g. Company 1). Several insurance companies focused on marketing initiatives; Company 13 upgraded its chatbot tool so that people could make a pre-assessment of a possible infection, and the tool also proposed a possible health insurance policy in specific cases. Regarding support to human resources, many insurance companies introduced remote working to reduce the spread of the disease and protect their employees (e.g. Company 27). These initiatives were driven by a relevant technology impulse, as insurance companies were able to exploit their existing technologies to address and aggressively ‘take on’ the new needs emerging from the market, handling them in an efficient and innovative way, and possibly gaining competitive advantage.

The nature of innovation rationales

Figure 1 shows the distribution of initiatives, cluster by cluster, along the insurance value chain. Most Aggression initiatives were related to product development (10 out of 35 initiatives), generating technologically-enabled products to address new risks. Expansion initiatives were related more closely to contract administration and customer services (12 out of 26), these often being extensions of existing (and purchased) products to cover new risks. A good number of Reaction initiatives (eight out of 32) concerned claims management, where insurance companies exploited their existing technologies to continue serving their customers. Lastly, Adaptation initiatives were frequently implemented in underwriting (five out of 19), with discounts or extensions to premium payments. While several contract administration and customer services initiatives were put forward to manage people’s daily routines, we noticed something similar in product development. Therefore, market demand linked to unsatisfied customer needs potentially opens up room for new products (Maier et al. 2016), despite the practical difficulties that arise when insurance companies handle new risk insurance under conditions of scarce historical data and few models for measuring risks accurately (Śliwński et al. 2017).

Considering initiatives where technology is relevant (i.e. Reaction and Aggression), our findings support those found in previous studies (Eling and Lehmann 2018; Stoeckli et al. 2018) on the impact of digitalisation on the insurerance value chain. For instance, digital technologies made certain marketing communication strategies possible (e.g. Company 13’s online symptom checker for COVID-19 that can, in some cases, suggest suitable health coverage), attracting prospects and eventually offering insurance products and services, or were of assistance in insurance sales (e.g. enabling online sales via the web or apps, as in the case of Company 20). They also supported a smoother interaction with agents and employees (e.g. digital touchpoints and distance working), the adoption of new systems for claims management (e.g. drones, video calls and apps), the offering of new services (e.g. telemedicine, digital tools for providing psychological support, tools for identifying available public financial aid), and the improvement of policies for actual customers (e.g. including new policies such as those for COVID-related issues). Furthermore, our research supports the claim made by Stoeckli et al. (2018) that InsurTech enables innovations coupled with an underwritten insurance product (e.g. Company 1 offered triage tools and a symptom checker to its highest risk members to collect data and assess their status and needs more efficiently), as well as those that are not coupled to an underwritten insurance product but are packaged with complementary products (e.g. Company 9 offered their customers a free online consultation service with qualified personal trainers, chefs and dieticians).

The relevance of such initiatives for society can be observed from several points of view. Many insurance companies responded to increasing health concerns. More than half the initiatives dealt specifically with health issues, from the risk of infection to lockdown-related psychological issues (see, for instance, the 24/7 hotline set up by Company 22 to help people get through the crisis). Some innovations in the health insurance sector actually produced more frequent interactions between customers and insurers. For instance, Company 8 opened a hotline for coronavirus enquiries, while Company 9 introduced its ‘heroes against loneliness’ initiative, where employees spend time on the phone with customers in high-risk groups, asking them about their well-being, and they set up a platform where people can register and connect with each other. Other initiatives responded to economic and financial issues, such as the decision taken by Company 1 to give grace periods for paying insurance premiums, which was open to both employees and individuals. The aim of several initiatives was to solve work-related issues in insurance companies, in particular by introducing remote working, and also extending coverage to risks arising from an increase in remote working within other industries. Company 2, for instance, extended existing policy guarantees to cover business clients in specific situations, such as against cyberattacks, since most of their employees were working remotely. Lastly, other initiatives were designed to ensure continuity in their customers’ daily lives, for instance, digital home inspections to assess damages (see Company 25).

Conclusions

The COVID-19 pandemic gave rise to a number of serious issues for society. Due to their socio-economic importance, insurance companies were well-placed to play an important role in addressing these problems. Many insurance companies supported the general public, for instance by making large donations to health systems (e.g. Company 8 gifted 350,000 surgical masks to hospitals) or supporting people in financial distress (e.g. Company 9 donated to the EUR 200 million insurance Federation contribution to the EUR 1 billion solidarity fund created by the French government to support small and medium enterprises, very small enterprises and self-employed workers in difficulty).

At the same time, although the insurance industry has not traditionally fully exploited its innovation potential due to its conservative approach (Nam 2018), we found that insurance companies are indeed innovating. With the emerging of a particularly serious new risk, insurance companies took the opportunity to rethink their value chain and develop new products and processes, exploiting their existing technology and tapping into their customers’ needs. This research offers valuable insight into the innovation initiatives undertaken by insurance companies, and its aim is to share meaningful findings and contribute to our understanding of how insurance companies respond to highly uncertain events.

By grouping the initiatives according to the relevance of technology in each case and the kind of risks covered, we extrapolated four types of rationale behind the initiatives, creating four classes. Depending on whether they made use of and/or upgraded existing technology or implemented new technologies, insurance companies were able to handle pre-existing risks, and so continue to serve their customers in an effective and efficient way (Reaction initiatives), or tackle new risks (Aggression initiatives). However, despite the clear impulse towards digitalisation and the ensuing wide set of potential opportunities, we also identified a broad selection of initiatives where the role of technology was negligible (Adaptation and Expansion strategies). Some reactive innovations responded to increasing health issues, others were more strictly associated with economic and financial difficulties. Others still related to work-related matters in insurance companies, in particular remote working, but there were also instances of extending cover against risks arising from an increase in distance working within other industries. Lastly, some initiatives were designed to establish continuity in everyday life.

Overall, it emerges that insurance companies have the room and capability to innovate, and can leverage technology on a case-by-case basis to cover new and existing risks in a process that involves the entire value chain, with strategies weighted according to each specific activity. For instance, important primary activities such as product development, sales and claims management show that, in a relevant number of initiatives, exploiting new technology is crucial for the success and competitiveness of the business and provides a thriving background for incumbents to collaborate with more innovative players, including among InsurTech start-ups.

Our research aims to provide tangible support to insurance companies, which can help them design their future innovation undertakings with a clear idea of what they wish to achieve, or maintain, in the market. Insurance companies that are mainly concerned with safeguarding their market presence and whose innovation effort is low are likely to rely mostly on Adaptation initiatives, as these do not require much investment in technology and enable insurance companies to concentrate on existing risks and their current customers. However, although Adaptation initiatives can lead to customer satisfaction in the short term, our suggestion is that insurance companies should start paying closer attention to potential long-term survival risks that could sneak in under the cover of complacency. On the contrary, insurance companies that want to use innovation to garner higher market relevance in the future may focus their efforts on Aggression initiatives, leveraging most innovative technologies to gain power immediately in an emerging market created by new risks. This strategy could lead to sustainable long-term competitive advantages, but these companies should carefully consider two main risks. On the one hand, despite the huge volumes of data made available through new technologies, insurance for these risks may be less easy to secure or less extensive due to a lack of pertinent information or models (McAlea et al. 2016) or, at least, be more uncertain. On the other hand, investing in technology is not a guarantee of success per se, as the benefits would not follow naturally and investment could be unjustified.

These considerations may assume even higher relevance in the case of future pandemics or global systemic events, today considered decidedly more probable than in the past. Extreme weather is considered the most likely serious risk, climate action failure the second in terms of both likelihood and impact, and infectious diseases are seen as the most serious risk in terms of impact and rank fourth in terms of likelihood (World Economic Forum 2021). Our results aim to support future innovative initiatives in the event of these situations, providing a set of rationales that insurance companies could draw upon to cover different functions, from continuing to serve their customers and protect them from existing risks, to working towards protecting them from new uncertainties, possibly by turning to technology to gain that extra edge.

Policymakers should act coherently with the insurance sector and consider the new ways in which this industry is innovating, in order to reflect these aspects in government strategy, regulations and legislative flexibility when required, as well as reviewing the mechanisms they could put in place (e.g. regulatory ‘sandboxes’). Said otherwise, new challenges in this field are the order of the day.

Lastly, our research aims to contribute to the literature on insurance innovation by recognising the crucial importance of the impulses derived from technology and market demands that translate into innovation within the industry. To conclude, we have built on these findings to provide a comprehensive view of the innovation mechanisms that enter into play when these two forces come together. Furthermore, by studying the extreme case of the COVID-19 pandemic, we have analysed the complex interactions between the two and the kind of innovation initiatives that companies could undertake in the future. Nevertheless, further research is needed to evaluate these innovative initiatives and examine their short- versus medium- to long-term benefits to society. In addition, we need to study the patterns and persistence of innovation impulses within the now evolving insurance industry.

References

Altamirano, M.A., and C.P. van Beers. 2018. Frugal innovations in technological and institutional infrastructure: Impact of mobile phone technology on productivity, public service provision and inclusiveness. The European Journal of Development Research 30 (1): 84–107.

Ashta, A. 2018. News and trends in Fintech and digital microfinance: Why are European MFIs invisible? FIIB Business Review 7 (4): 232–243.

Axenbeck, J., and P. Breithaupt. 2021. Innovation indicators based on firm websites—Which website characteristics predict firm-level innovation activity? PLoS ONE 16 (4): e0249583.

Banerjee, S., T. Hemphill, and P. Longstreet. 2018. Wearable devices and healthcare: Data sharing and privacy. The Information Society 34 (1): 49–57.

Baregheh, A., J. Rowley, and S. Sambrook. 2009. Towards a multidisciplinary definition of innovation. Management Decision 47 (8): 1323–1339.

Brem, A., and K.I. Voigt. 2009. Integration of market pull and technology push in the corporate front end and innovation management—Insights from the German software industry. Technovation 29 (5): 351–367.

Capgemini and Efma. 2019. World Insurance Report 2019.

Cather, D.A. 2020. Reconsidering insurance discrimination and adverse selection in an era of data analytics. The Geneva Papers on Risk and Insurance—Issues and Practice 45: 426–456.

de Oliveira Malaquias, F.F., and Y. Hwang. 2018. An empirical investigation on disclosure about mobile banking on bank websites. Online Information Review 42 (5): 615–629.

Derikx, S., M. de Reuver, and M. Kroesen. 2016. Can privacy concerns for insurance of connected cars be compensated? Electronic Markets 26 (1): 73–81.

Di Stefano, G., A. Gambardella, and G. Verona. 2012. Technology push and demand pull perspectives in innovation studies: Current findings and future research directions. Research Policy 41 (8): 1283–1295.

Dijksterhuis, C., B. Lewis-Evans, B. Jelijs, O. Tucha, D. de Waard, and K. Brookhuis. 2016. In-car usage-based insurance feedback strategies. A Comparative Driving Simulator Study. Ergonomics 59 (9): 1158–1170.

Downe-Wamboldt, B. 1992. Content analysis: Method, applications and issues. Health Care for Women International 13: 313–321.

Du Preez, N. D., and L. Louw. 2008. A framework for managing the innovation process. In PICMET’08—2008 Portland International Conference on Management of Engineering & Technology, 546–558. IEEE.

Edwards-Schachter, M. 2018. The nature and variety of innovation. International Journal of Innovation Studies 2 (2): 65–79.

Eling, M., and M. Lehmann. 2018. The impact of digitalization on the insurance value chain and the insurability of risks. The Geneva Papers on Risk and Insurance—Issues and Practice 43 (3): 359–396.

Elo, S., and H. Kyngäs. 2008. The qualitative content analysis process. Journal of Advanced Nursing 62 (1): 107–115.

Garcia, R., and R. Calantone. 2002. A critical look at technological innovation typology and innovativeness terminology: A literature review. Journal of Product Innovation Management: An International Publication of the Product Development & Management Association 19 (2): 110–132.

Geum, Y., H. Jeon, and H. Lee. 2016. Developing new smart services using integrated morphological analysis: Integration of the market-pull and technology-push approach. Service Business 10 (3): 531–555.

Guo, Y., and C. Liang. 2016. Blockchain application and outlook in the banking industry. Financial Innovation 2 (1): 24.

Heinonen, K., and T. Strandvik. 2020. Reframing service innovation: COVID-19 as a catalyst for imposed service innovation. Journal of Service Management 32 (1): 101–112.

Hiestermann, J., and S.L. Ferreira. 2017. Cloud-based agricultural solution: A case study of near real-time regional agricultural crop growth information in South Africa. International Archives of the Photogrammetry, Remote Sensing & Spatial Information Sciences 42: 79–82.

Kose, I., S. Guner, B. Isguzerer, and M.E. Sisli. 2018. A case study of the extended interactive innovation management model in insurance company. In International Conference on Innovation and Entrepreneurship. Academic Conferences International Limited.

Krippendorff, K. 1980. Content analysis: An introduction to its methodology. Newbury Park: Sage.

Lakdawalla, D., A. Malani, and J. Reif. 2017. The insurance value of medical innovation. Journal of Public Economics 145: 94–102.

Lanfranchi, D., and L. Grassi. 2021. Translating technological innovation into efficiency: the case of US public P&C insurance companies. Eurasian Business Review. https://doi.org/10.1007/s40821-021-00189-7.

Lehrer, C., A. Wieneke, J. vom Brocke, R. Jung, and S. Seidel. 2018. How big data analytics enables service innovation: Materiality, affordance, and the individualization of service. Journal of Management Information Systems 35 (2): 424–460.

Liedtke, P.M. 2021. Vulnerabilities and resilience in insurance investing: Studying the COVID-19 pandemic. The Geneva Papers on Risk and Insurance—Issues and Practice 46 (2): 266–280.

Maier, M.A., M. Hofmann, and A. Brem. 2016. Technology and trend management at the interface of technology push and market pull. International Journal of Technology Management 72 (4): 310–332.

McAlea, E.M., M. Mullins, F. Murphy, S.A. Tofail, and A.G. Carroll. 2016. Engineered nanomaterials: Risk perception, regulation and insurance. Journal of Risk Research 19 (4): 444–460.

McAneney, J., D. McAneney, R. Musulin, G. Walker, and R. Crompton. 2016. Government-sponsored natural disaster insurance pools: A view from down-under. International Journal of Disaster Risk Reduction 15: 1–9.

McCrea, M., and M. Farrell. 2018. A conceptual model for pricing health and life insurance using wearable technology. Risk Management and Insurance Review 21 (3): 389–411.

McFall, L., and L. Moor. 2018. Who, or what, is insurtech personalizing? Persons, prices and the historical classifications of risk. Distinktion: Journal of Social Theory 19 (2): 193–213.

McFall, L. 2019. Personalizing solidarity? The role of self-tracking in health insurance pricing. Economy and Society 48: 52–76.

McKinsey & Company. 2018. Digital Insurance in 2018: driving real impact with digital and analytics.

Meyers, G., and I. Van Hoyweghen. 2018. Enacting actuarial fairness in insurance: From fair discrimination to behaviour-based fairness. Science as Culture 27 (4): 413–438.

Nam, S. 2018. How much are insurance consumers willing to pay for blockchain and smart contracts? A Contingent Valuation Study. Sustainability 10 (11): 4332.

Nicolov, M., and A.D. Badulescu. 2012. Different types of innovations modeling. Annals of DAAAM for 2012 & Proceedings of the 23rd International DAAAM Symposium 23 (1): 1071–1074.

OECD. 2020. Insurance sector responses to COVID-19 by governments, supervisors and industry. https://www.oecd.org/daf/fin/insurance/Insurance-sector-responses-to-COVID-19-by-governments-supervisors-and-industry.pdf.

Porter, M.E. 2008. Competitive advantage: Creating and sustaining superior performance. New York: Simon and Schuster.

Qian, X. 2021. The impact of COVID-19 pandemic on insurance demand: the case of China. The European Journal of Health Economics 22 (7): 1017–1024.

Rahlfs, C. 2007. Redefinition der Wertschopfungskette von Versicherungsunternehmen, Gabler Edition Wirtschaft. Wiesbaden: Deutscher Universitats-Verlag.

Sampson, L., C.K. Ettman, S.M. Abdalla, E. Colyer, K. Dukes, K.J. Lane, and S. Galea. 2021. Financial hardship and health risk behavior during COVID-19 in a large US national sample of women. SSM-Population Health 13: 100734.

Sandelowski, M. 1995. Qualitative analysis: What it is and how to begin? Research in Nursing & Health 18: 371–375.

Shin, S.H., H. Ji, and H. Lim. 2021. Heterogeneity in preventive behaviors during COVID-19: Health risk, economic insecurity, and slanted information. Social Science & Medicine 278: 113944.

Śliwński, A., A. Karmańska, and T. Michalski. 2017. European insurance markets in face of financial crisis: Application of learning curve concept as a tool of insurance products innovation-discussion. Journal of Reviews on Global Economics 6: 404–419.

Stoeckli, E., C. Dremel, and F. Uebernickel. 2018. Exploring characteristics and transformational capabilities of InsurTech innovations to understand insurance value creation in a digital world. Electronic Markets 28 (3): 287–305.

The Geneva Association. 2012. The social and economic value of insurance. Auhor: Eric Grant. September.

Urbinati, A., D. Chiaroni, V. Chiesa, and F. Frattini. 2020. The role of digital technologies in open innovation processes: An exploratory multiple case study analysis. R&D Manage 50 (1): 136–160.

Van den Ende, J., and W. Dolfsma. 2005. Technology-push, demand-pull and the shaping of technological paradigms—patterns in the development of computing technology. Journal of Evolutionary Economics 15 (1): 83–99.

Voss, C.A. 1984. Technology push and need pull: A new perspective. R&D Manage 14 (3): 147–151.

Weidner, W., F.W. Transchel, and R. Weidner. 2016. Classification of scale-sensitive telematic observables for riskindividual pricing. European Actuarial Journal 6 (1): 3–24.

Wiegard, R.B., and M.H. Breitner. 2019. Smart services in healthcare: A risk-benefit-analysis of pay-as-you-live services from customer perspective in Germany. Electronic Markets 29 (1): 107–123.

Wijnands, J.S., J. Thompson, G.D. Aschwanden, and M. Stevenson. 2018. Identifying behavioural change among drivers using long short-term memory recurrent neural networks. Transportation Research Part F: Traffic Psychology and Behaviour 53: 34–49.

World Economic Forum. 2020. The global risks report 2020.

World Economic Forum. 2021. The global risks report 2021.

Yamasaki, K., and R. Hosoya. 2018. Resolving asymmetry of medical information by using AI: Japanese people’s change behavior by technology-driven innovation for Japanese Health Insurance. In 2018 Portland International Conference on Management of Engineering and Technology (PICMET), 1–5). IEEE.

Zavolokina, L., M. Dolata, and G. Schwabe. 2016. The FinTech phenomenon: Antecedents of financial innovation perceived by the popular press. Financial Innovation 2 (1): 1–16.

Zweifel, P. 2021. Bridging the gap between risk and uncertainty in insurance. The Geneva Papers on Risk and Insurance—Issues and Practice 46 (2): 200–213.

Zweifel, P., and R. Eisen. 2012. Insurance economics. New York: Springer.

Acknowledgements

The authors would like to thank the Editor and the anonymous Reviewers for their valuable comments and suggestions that greatly contributed to the improvement of the quality of this paper. We would also like to express our gratitude to Claudio Garitta who kindly reviewed an earlier version of the empirical analysis.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: List of insurance companies analysed

Appendix: List of insurance companies analysed

Company ID | Headquarters | Net written premiums (USD billion), 2018 |

|---|---|---|

1 | United States | > 90 |

2 | France | > 90 |

3 | China | > 90 |

4 | China | > 90 |

5 | United States | > 90 |

6 | Japan | > 90 |

7 | United States | 70–90 |

8 | Germany | 70–90 |

9 | Italy | 70–90 |

10 | China | 50–70 |

11 | United States | 50–70 |

12 | United States | 50–70 |

13 | United States | 50–70 |

14 | Japan | 50–70 |

15 | Germany | 50–70 |

16 | Japan | 50–70 |

17 | India | 30–50 |

18 | United States | 30–50 |

19 | Japan | 30–50 |

20 | United Kingdom | 30–50 |

21 | China | 30–50 |

22 | United States | 30–50 |

23 | United States | 30–50 |

24 | United States | 30–50 |

25 | Switzerland | 30–50 |

26 | United States | 30–50 |

27 | France | 30–50 |

28 | United States | 30–50 |

29 | France | 30–50 |

30 | United States | 30–50 |

Rights and permissions

About this article

Cite this article

Lanfranchi, D., Grassi, L. Examining insurance companies’ use of technology for innovation. Geneva Pap Risk Insur Issues Pract 47, 520–537 (2022). https://doi.org/10.1057/s41288-021-00258-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-021-00258-y